Sales tax

VAT reporting

EPR reporting

Invoices

for cross-border company sales

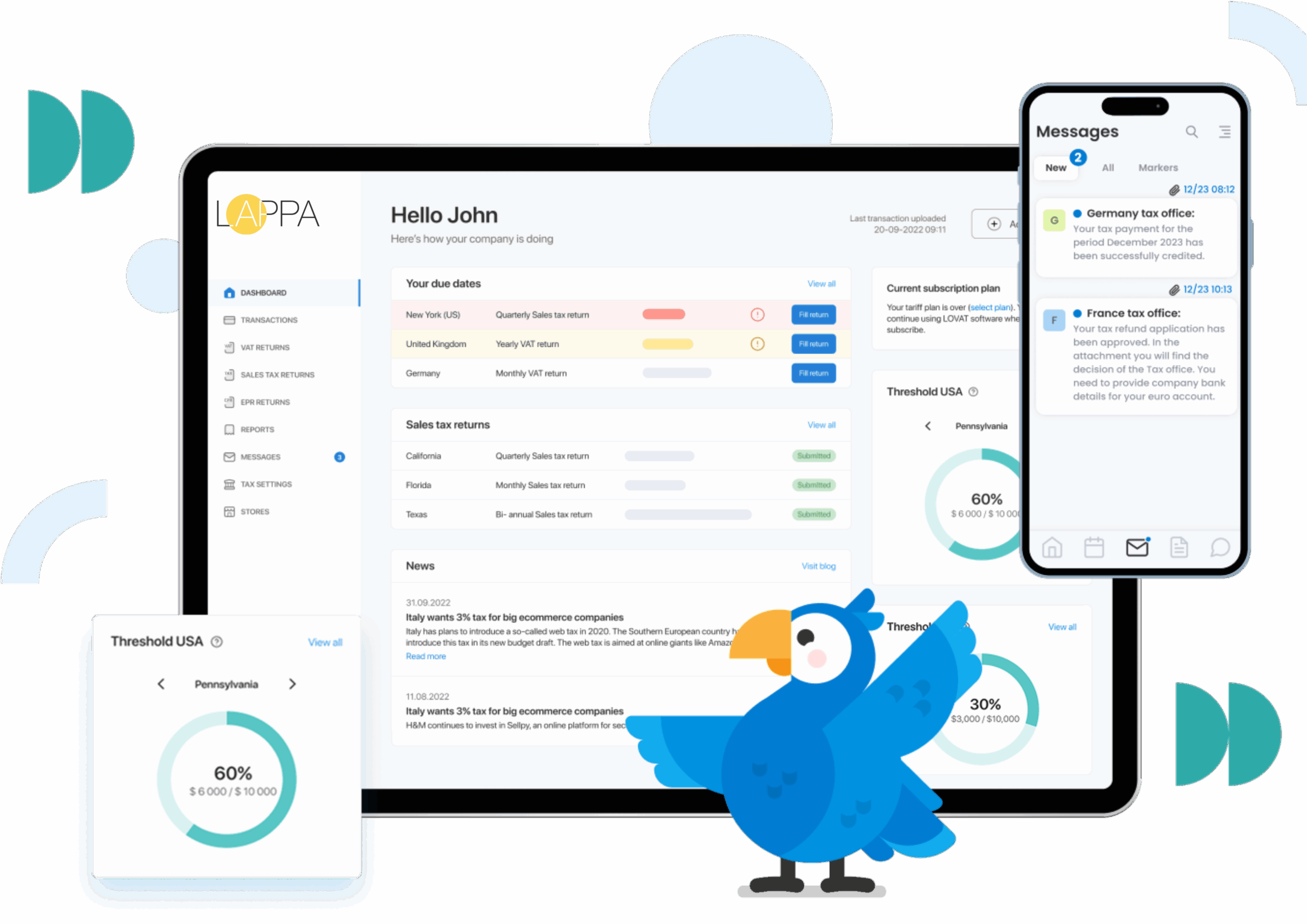

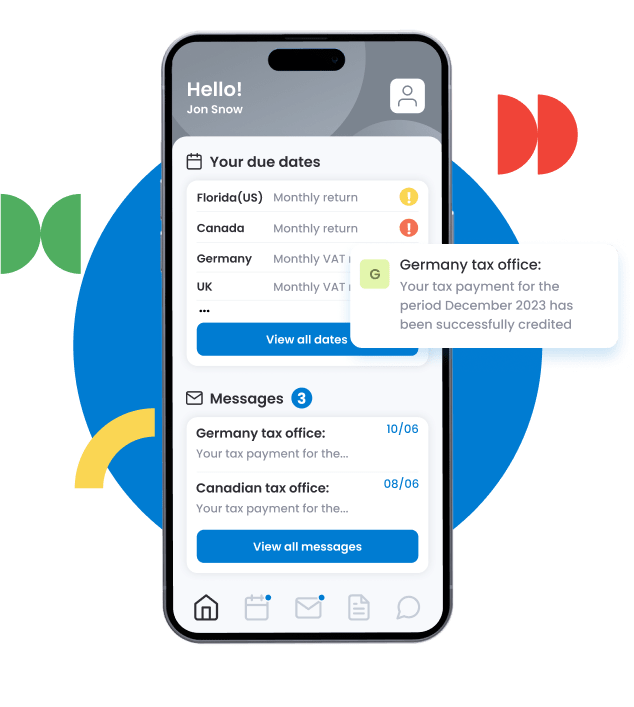

Run international sales with confidence using one unified system. Lappa brings tax calculation, invoicing, EPR, and marketplace automation together to support global operations.

110+

Countries supported

25+

Integrations

100%

Regulatory compliance

1 min

Average response time

Everything you need for

cross-border operations

Manage Extended Producer Responsibility across EU. Track registration thresholds, submit reports on time, and ensure full compliance with packaging waste regulations in every market you operate.

Generate compliant invoices instantly for 111 countries. Multi-currency support (123 currencies), automated tax calculations, and professional templates in multiple languages.

Calculate accurate VAT/sales tax in real-time for 111 countries and 123 currencies. Seamless API integration to your checkout. Always updated with the latest tax rates and regulatory changes.

Complete solution for marketplace operators. Automate tax calculations, handle remittances, ensure DAC7 compliance, and generate detailed reports for all your merchants.

Seamless integration with leading global platforms

Global software for businesses of any size

For e-commerce sellers

Our ecosystem ensures compliance for marketplaces and online stores: L'Tax calculates taxes, L'Invoice issues documents, L'EPR manages obligations, and L'Marketplace automates platforms.

For providers of digital services

Accurate tax calculations based on customer location and your services. L'Tax determines correct rates for 111 countries and 123 currencies. Track registration thresholds and stay in control of all tax obligations while you expand globally.

For marketplace facilitators

L'Marketplace automates tax calculation and remittance. Collect all required data for DAC7 reporting. Generate compliant invoices for buyers and comprehensive tax reports for your merchants - all in one place.

How it works

Why businesses choose

Lappa

- Easy to setup, easy to use

- Four integrated products - L'EPR, L'Invoice, L'Tax, L'Marketplace working as one ecosystem

- Support in 2 languages, expert accountants ready to help

- We provide services in 111 countries

- 123 currencies supported

- The fastest support in the industry - we answer within 1 minute

- Slow support, replies on average within a week

- Single-product solutions - need multiple tools

- Support in 1 language

- Provide services in 27 countries

- No transparent pricing

Our friendly support team is here to help

We fundamentally do not use robots and answering machines when supporting our clients – only real, competent tax professionals who understand your business.

Our support team is ready to help with any questions about L’EPR, L’Invoice, L’Tax, or L’Marketplace – wherever is most convenient for you

What our customers say about us

Lappa is trusted by hundreds of companies

Frequently asked questions

Do I need all Lappa products to get started

No. You can use L’EPR, L’Invoice, L’Tax, or L’Marketplace independently, depending on your business model and compliance needs.

How does Lappa help with EPR compliance in the EU

With L’EPR, Lappa supports EPR registration, threshold tracking, and reporting across EU countries, helping you stay compliant with packaging waste and other producer responsibility regulations.

Is Lappa suitable for both online sellers and marketplaces

Yes. Lappa supports online sellers through L’Tax, L’Invoice, and L’EPR, and marketplace operators through L’Marketplace, which automates tax and reporting obligations at platform level.

Is Lappa updated with regulatory changes

Yes. All Lappa products are continuously updated to reflect the latest tax rates, EPR requirements, and regulatory changes across supported markets.

Who should use L’Marketplace

L’Marketplace is designed for marketplace operators who need to automate tax calculations, manage remittances, ensure DAC7 compliance, and generate detailed merchant reports.